Are things looking up for eCommerce?

)

2024 started off badly for eCommerce sales in the UK and it looked like demand might actually be getting even more suppressed; a real blow to a market that has seen 35 consecutive months of negative monthly year-on-year (YoY) growth following the lockdown periods (the IMRG index has recorded flat growth twice in that timeframe, but no convincing growth).

But – whisper it – are we on the cusp of a return to growth?

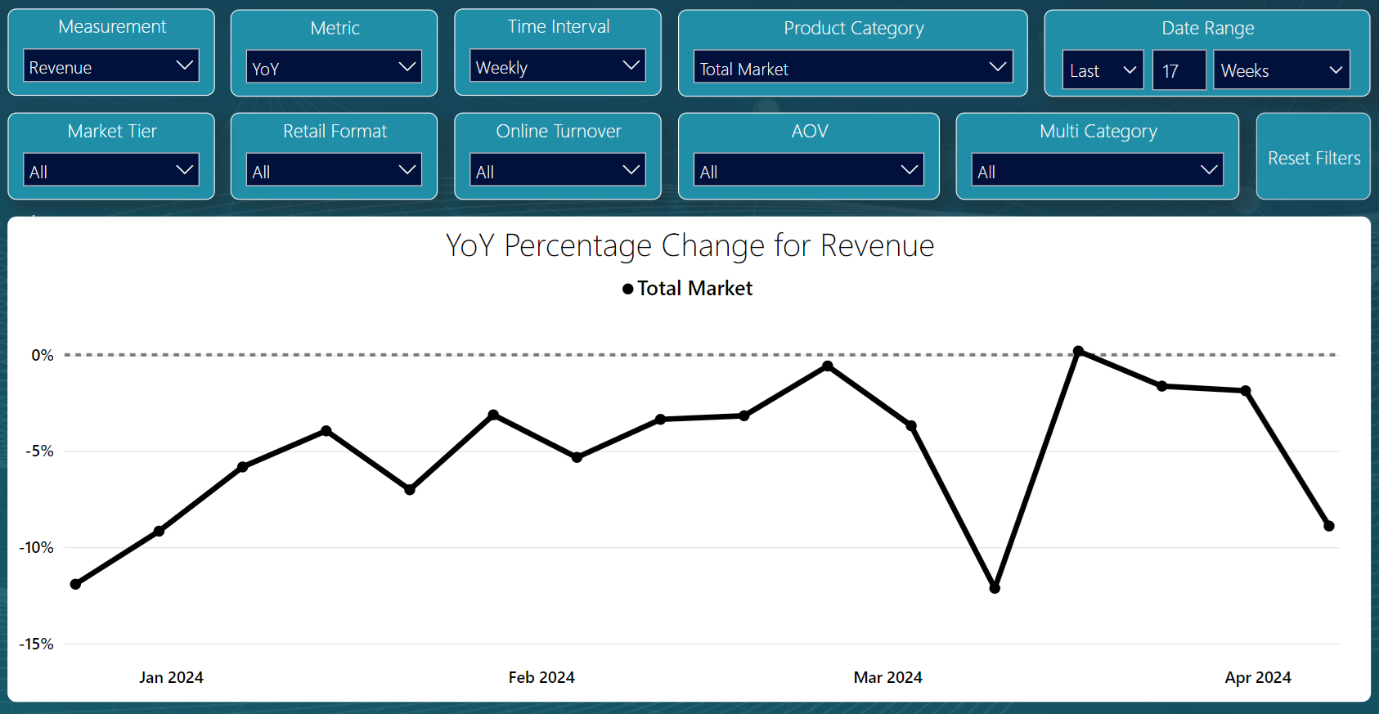

This graph shows the growth in online sales revenue across the four months of 2024 so far, split out by week. In the final two weeks of December 2023, we saw some strong growth for the week before Christmas (it rained a lot that week and, it seems that combined with the final ordering date messaging, online saw a boost), but the following week recorded a big decline as a consequence of that being pulled forward. This seemed to drag growth rates down at the start of 2024 to an extent that made any positive growth seem unlikely any time soon. You can see just how far down the year started.

But: since then, the line has followed a consistent trajectory up toward the 0% baseline. The exception to that is the big drop in mid-March, but this is due to Mothers’ Day moving forward in the calendar, so the bulk of the buying for that retail event is also moved around and the YoY therefore does not represent a reliable like-for-like comparison anymore. The second dip (latest week on the right-hand side) is a consequence of the same thing with Easter moving forward in the calendar. Knocking those two temporary skews out, the line is definitely pushing in the right direction.

There’s more too. A primary reason why eCommerce has been struggling over the past two years relates to a sharp dip in conversion. There is some variation by product category, but the overall conversion rate on eCommerce sites has fallen by around 20% compared to where it was before the cost-of-living period began in earnest, bringing with it huge spikes in inflation. Looking at March 2024 however, it actually rebounded 0.1 percentage points compared to the same month in 2023. That might not sound like much, but when average conversion rates hover around the 3% mark, it all adds up; and the significant point here is that it has gone up again, which has not been happening for a long while.

The real pinch-point in the conversion funnel has been on the product page, with a huge fall in the percentage of visitors who add something to their baskets on eCommerce sites. Pre-cost-of-living period, it was around the 17% mark but it fell as low as 12% in 2022. For the last quarter of 2023, it was a percentage point higher than the same quarter in the previous year. Again, not evidence of a comprehensive turnaround, but certainly better news than that to which we have become accustomed.

It might not be that we can pop the champagne corks quite yet. But there is a definite creeping sense that, while things are not necessarily getting markedly better, they seem to have ceased getting markedly worse.

Latest News

-

Your Month in eCommerce

26 Apr 2023Bite-size updates on what happened in eCommerce this month, to keep you ahead of the curve and inform your campaigns. -

Deep-dive: Future of Retail and eCommerce 2023

24 Apr 2023 Raconteur in association with eCommerce ExpoFind out what 2023 has in store for eCommerce and Retail, in a post-Covid world where customers' expectations keep rising -

The 14th Year of IMRG's Consumer Home Delivery Review (2022/23)

21 Apr 2023 IMRGIMRG's latest research tracks the level of customer satisfaction and expectation regarding online delivery. -

Parcel Monitor: Europe E-Commerce Logistics Market Report 2023

29 Mar 2023 Parcel MonitorEurope is home to a rapidly growing e-commerce logistics industry that has seen significant growth in recent years. With the rise of online shopping, the demand for efficient and reliable logistics se ... -

London, 18th January 2023: CloserStill Media, the producer of market-leading business events, exhibitions and conferences, today announced it has purchased a majority stake in CommerceNext, a leading ...

-

Shopify is changing the face of commerce and supporting merchants in the new era: Connect to Consumer (C2C).

-

Did you miss the chance to enter PHL Group's Prize Draw to win a gourmet Fortnum and Mason Hamper worth £140? Well, you're in luck, as they have extended the entry date until the 4th November. But hur ...

-

Standing room only at the final day of CloserStill Media's eCommerce Expo and Technology for Marketing 2022

30 Sep 2022The exhibition floor and conference theatres were jam-packed, as thousands of retailers and marketers joined the UK’s biggest two-day eCommerce and marketing technology event. -

The UK’s biggest eCommerce and marketing technology events returned in-person, with a successful debut at London ExCeL, welcoming thousands of leading retailers and brands on day one.

-

Digital commerce and the future of e-commerce as we know it: Interview with Karl Lillrud

22 Sep 2022 PropellerIt is often said that the best business people are those who live to solve problems - not just sell products. But sometimes it can be hard to see the wood for the trees. Organisations can struggle to ... -

Three little letters that spell customer success: CRM

22 Sep 2022 PropellerIt costs 80% less to keep a customer than to acquire one, yet brands are continuing to fall short in how they build relationships with their customers. Customer Relationship Management (CRM) is essent ... -

Your Month of August in eCommerce

Alyssia Smith, Senior Content Manager at CloserStill MediaBite-size updates on what happened in eCommerce and marketing this month, to keep you ahead of the curve and inform your campaigns.

)

)

)

)

)

)

)

)

)

)

)